Update: Yesterday, when cryptos suddenly tumbled amid the market’s delayed realization that the EU was set to vote on Monday on a new regulatory framework for crypto assets which could accelerate passage of a measure banning “proof of work” mining, which industry executives said could “practically ban key digital currencies including Bitcoin and Ethereum in Europe“, we said (see below) that the good news for crypto bulls is that “a small majority of committee members may vote against the measure.” If so, we added, “the selloff on Sunday night is merely the latest successful attempt at shaking out the weak holders.”

That’s precisely what happened because moments ago, the EU Parliament voted against a proof-of-work ban.

Crypto pundit Patrick Hansen has more details in a tweetstorm:

BREAKING: The ECON committee of the EU Parliament just voted against the de-facto POW-ban: 32 against, 24 in favor.

Big relief & political success for the bitcoin & crypto community in the EU. Will share a breakdown of the vote and what’s next here in this thread.

A majority of MEPs from the EPP, ECR, Renew & ID voted against it, while a minority of MEPs from Greens, Socialists and Democrats (S&D), and European United Left (GUE) mainly voted in favor. Instead, this alternative amendment from Stefan Berger was supported.

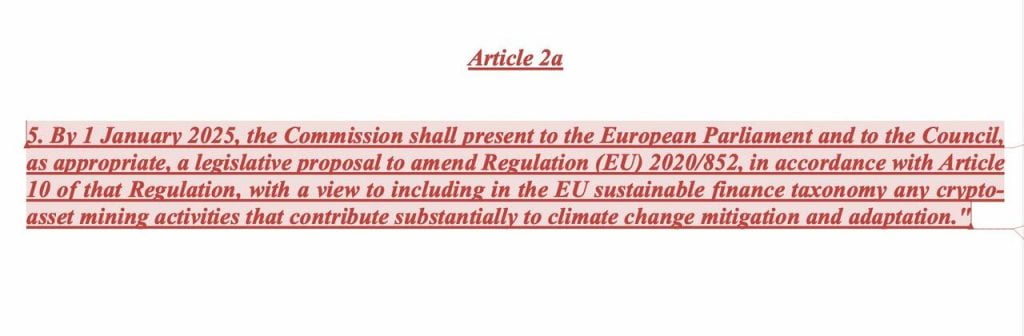

What does that mean for POW? Mining will in all likelihood no longer be addressed within this MICA regulation, but added to the EU sustainable finance taxonomy. Here is a recap of this suggestion

1/8 There is a new compromise draft for the handling of proof-of-work in the #cryptocurrency regulation of the European Parliament.

— Patrick Hansen (@paddi_hansen) March 7, 2022

The #Bitcoin (POW) ban was dropped. #BTC

Instead #crypto could be added to the EU taxonomy for sustainable activities. A quick update thread 👇 https://t.co/GiuTPtotZ4

MiCA regulates financial instruments and financial service providers. It makes way more sense to address any concerns around the sustainability of mining technology separately.

Whats next? The MiCA draft will be negotiated in the so-called “trilogues” between the EU Commission/Parliament/Council. After their final agreement (couple of months) the law will enter into force. However, companies will have a 6m transition period to comply with the requirements.

Any chances left for the POW-ban? The groups that lost the vote have one last option. They could veto a fast-track procedure of MiCA through the trilogues & bring the discussion to the plenary of the Parliament. They need 1/10 of the votes of the EP to do so, which they have.

That would bring the discussion around POW into the high-level policy arena. As we can’t predict how that would play out, it should be prevented. Even if it doesn’t change the vote on POW, it would unnecessarily delay the regulation for at least a couple of months.

And even outside of this MiCA regulation, the discussion around POW-regulation is far from over. It will come back in the context of the sustainability taxonomy or in the upcoming data center regulation: So there is loads of work left in the months and years ahead.

But today is a big political success for crypto in the EU. Congrats to @DrStefanBerger for this political success and for his support for the crypto community. And thanks and congrats to everyone who contributed to making our concerns and voices heard. The crypto community in the EU has clearly become a political force! Looking forward to keep pushing Europe to embrace crypto.

With Bitcoin and ether trading near session highs following the news, a move facilitated by Elon Musk stating overnight that “I still own & won’t sell my Bitcoin, Ethereum or Doge fwiw”, those who bought cryptos yesterday are now well in the money…. Read More zerohedge