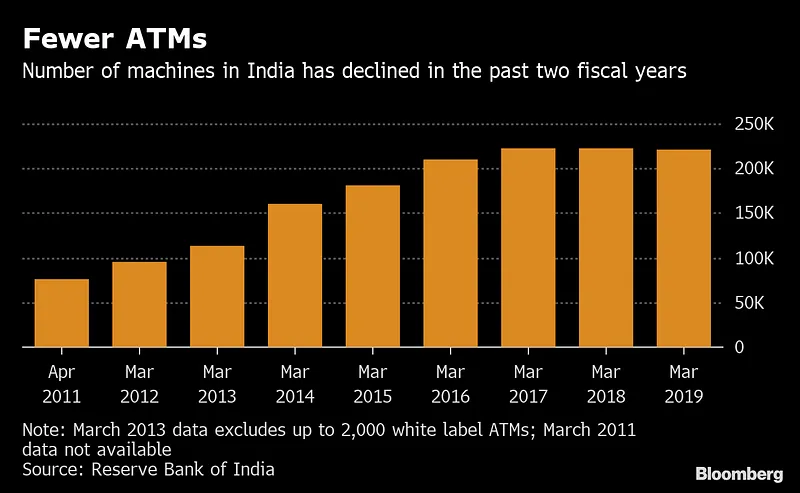

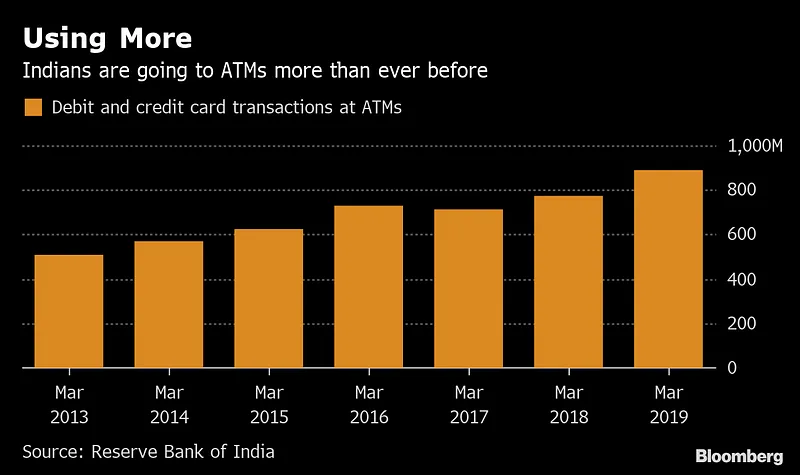

India: Banks are shutting down ATMs even as people use them more

The number of ATMs in the country shrank in the past two years despite an increase in transactions, Reserve Bank of India figures show.

Mumbai: Finding an ATM in India is getting tougher even as dependence on cash persists, thanks to tighter regulations that make it more costly to run the machines.

The drop may continue as banks and ATM operators struggle to absorb the cost of software and equipment upgrades mandated by the central bank last year to bolster security. That risks undermining Prime Minister Narendra Modi’s campaign of increasing financial inclusion in a nation where cash remains king less than three years after he pulled most banknotes from circulation.

“Declining numbers of ATMs will impact a large segment of the population, especially those who are socio-economically at the bottom of the pyramid,’’ said Rustom Irani, managing director at Hitachi Payment Services Pvt. Ltd., a provider of the machines. “Penetration in the country is already very low.” Read More

Dutch banks cut ATM locations, total drops by one third to below 5,000

Dutch News – Some 879 ATMs have disappeared in the last year, leaving the Netherlands with just 4,916 places where people can get cash money, figures from the Dutch national bank show.

Bank branches are closing or getting rid of their ATMs altogether, cutting the number of cash machines by one third in 2.5 years.

Opening hours have also been restricted, with most ATMs shutting down between 11pm and 6am. This temporary measure, meant to discourage robberies, is now the rule and only cash points near night spots remain open until 2am. Read More

The END of ATMs in Australia? Thousands of cash machines are removed across the country as banks go digital

- ATM’s and bank branches across Australia are continuing to close at a rapid rate

- Switch by customers to digital banking seen ‘Big Four’ banks switch their focus

- ANZ head of distribution Kath Bray said changes were a clear sign of the times

Daily Mail – As Australian banks continue to focus on digital transactions for customers, ATMs and bank branches are disappearing across the country, according to new data.

The analysis revealed close to 460 bank branches have shut down across the nation in recent years, and dating back to 2020, approximately 3800 previously active ATMs have been removed.

NSW alone now has 140 fewer in-store banks, and almost 300 suburbs don’t have a singular ATM to withdraw cash.

It is a similar story in Victoria, where 120 branches have permanently closed their doors to customers.

Tellingly, CBA now has 875 bank branches nationwide – compared to 1134 in February 2020.

Their number of ATMs has reduced to just over 2000 – in 2019 there were 4118 ATM’s in circulation.

UK ATMs decrease by 6,000, transaction value down 30%

Prior to the pandemic, the U.K. saw a rapid adoption of digital payments as consumers grew comfortable with shopping online. However, COVID-19 speeded up the digitalization of the entire payments industry during the lockdown, with millions of consumers choosing online payments over cash and ATMs, according to a press release.

UK: 300 ATMs Shutting Down Every Month

Data presented by BuyShares.co.uk shows the number of ATMs in the U.K. plummeted to 55,000 in December 2020, showing a loss of almost 6,000 ATMs within a year… Read More

NEARLY 500 cash machines, including 250 free-to-use ATMS, are being axed every month leaving millions unable to withdraw funds.

Ireland: ATMS slowly dying

In the last 2 years ATM use is down 25%. Has the pandemic changed the way we use cash forever? At one point pubs and markets would only accept cash; they are now encouraging contactless payments. Have we gone off cash? No longer paying with notes and coins and what does this mean for older people, who are seeing their local bank closing down and are still loyal to ATMs? Henry McKean sent us this report from Drogheda and Dublin. With Brian Hayes from the Banking & Payments Federation Ireland (BPFI).

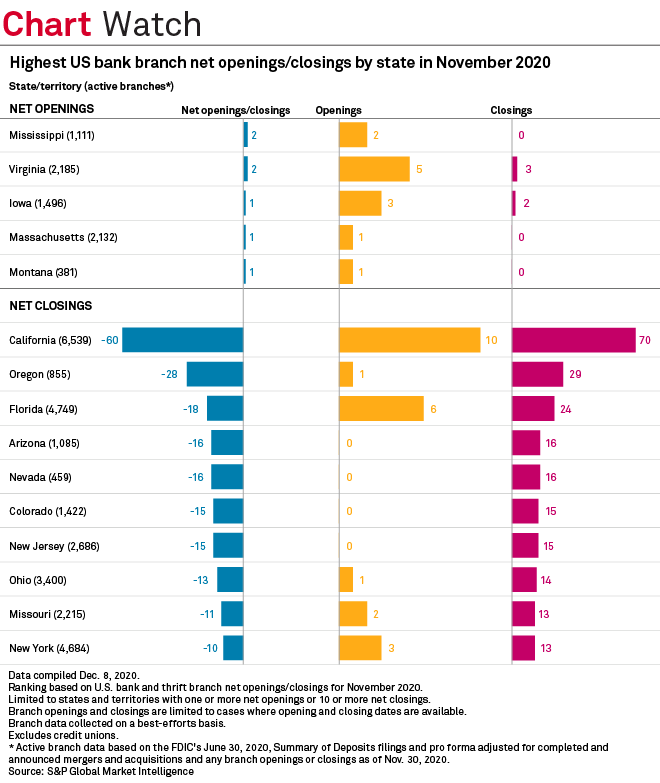

Coronavirus forces record number of ATMs, bank branches to close

Lines for ATMs here in Tulum last night…

— Larpseidon 🔱 (@Larpseidon) March 2, 2022

We’re still early. pic.twitter.com/4LAOEOTn4e

It’s disgusting that lines to ATMs are longer than on protests #Russians_are_fascists

— namorozi (@namorozi_) March 2, 2022

"Where do I go? Tell me please. Where will I run?"

— DW News (@dwnews) February 24, 2022

People across Ukraine were out on the streets, queuing at ATMs, looking for shelter or seeking ways to leave the country. pic.twitter.com/sMI2tynAbT

Samantha, I just tried 4 different ATMs where I live in Wisconsin, none of them working. I finally called my bank thinking it was my card, but they told me it's their first day "live" with a new processing system. 🤔

— Nurse Jayne (@JayneCoxRN) March 2, 2022

From a friend that works in only bank open between Mullumbimby and coast. Update: atms are empty, the internet and phones are down, Woolworths still closed, Coles in Casuarina completely empty.

— Treelady 🌳 (@ozychk21) March 2, 2022

People are coming in droves withdrawing money, we are the only financial institution

Russians lined up at banks and ATMs in fear for the fate of their savings as Western sanctions tanked the ruble. pic.twitter.com/q1vTq5BSGP

— DW News (@dwnews) March 2, 2022

If you’re not cleaning up in Kingscliff today you’re queuing – for food, petrol or even that quaint old thing called cash. No internet = no eftpos. The ATMs haven’t been this busy in years pic.twitter.com/GeZtPUOf0l

— Conal Hanna (@conalhanna) March 2, 2022